Personal Thoughts about Wise Investor Group Annual Seminar January 30, 2009

Posted by hslu in Economics.Tags: Economy, Stock Market, Wise investor group

1 comment so far

Summary of Wise Investor Group Annual Seminar

It was a cloudy morning when I arrived at the Marriott Fairview Park in Falls Church, Virginia around 11:15 on Sunday, January 24, 2009. I was 15 minutes away from the Wise Investor Group’s annual seminar on stock market. The Wise Investor Group, under the direction of Randy Beeman, has $1.4 billion of clients’ asset under management and they have since 1988 adopted a value-oriented philosophy in their investment of stocks and bonds. They also have a 2-hour radio talk show on Sunday from 9 to 11 AM on WMAL AM 630 station.

Maria and I have been attending this annual seminar for the past several years and I enjoyed it a lot. It provided a review of the major factors affecting the stock market in the year just past and a preview of what’s to come. It required a donation to the Orphan Foundation of America and a small lunch was provided for the attendees. On average, about 700 to 800 people att3ended the seminar and it ran for 3 hours including a 45 minute lunch.

Here are some highlights:

1. We are currently in a secular bear market and it started in March 2000 after the Internet and telecom bubbles. Here are market trends of a secular bear market:

a. Declining P/E Ratio

b. Rising Interest Rates

c. Offset Earning Growth

d. Volatile Markets

e. Lower Absolute Returns

2. There was no place to hide in 2008:

a. Material -45%

b. Utilities -32%

c. Telecom -34%

d. Staples -17%

e. Discretionary -35%

f. Energy -36%

g. Industrial -42%

h. Health –24%

i. Tech -43%

j. Financial -56%

3. Every major stock markets around the world also took a beating:

a. S&P 500 -36%

b. Brazil -37%

c. Euro -42%

d. FTSE 100 -29%

e. CAC 40 -38%

f. DAX -42%

g. Nikkei 225 -44%

h. Hang Seng -44%

4. The United States has gone through several years’ decline in GDP (yoy GDP growth)

a. 2004 3.6%

b. 2005 3.1%

c. 2006 2.9%

d. 2007 2.2%

e. 2008 0.52% (est.)

f. 2009 -1.4% (est.)

5. It appears that the global economy still has some down side risk. One good indicator of the global economy is the Baltic Dry Index. It tracks global dry good shipping rates around the global.

Notice a small uptrend in 2009. It is still too early to say the worst is over.

6. The US unemployment rate will likely reach 9% or higher in 12 months:

7. Housing crisis has not reached the bottom yet:

Here are two measures of housing affordability:

Decline from peak Decline from today

Decline to reach stability to Historical Level to Historical Level

Relative to Trad. Appreciation -43% -24%

Relative to Household Income -33% -17%

Relative to Rents -32% -18%

Conclusion: Still 15 – 25% decline from current level.

May need 9 to 12 months to reach equilibrium

8. Is the end of recession in sight? Here is a good indicator to watch: The U.S. Continuing Unemployment Claims. It usually peaked within a month or two of the official end of recession.

a. Here is the relationship of past recessions vs. official Continuing Claims:

b. Cycle peak in Continuing Claims Final Month of official US Recession

Nov 1970 Nov. 1970

May 1975 March 1975

June 1980 July 1980

November 1982 November 1082

June 1991 March 1981

November 2001 November 2001

9. The recession of 2007 officially started in December 2007. When will this recession end?

Unemployment (SA)

Jan. 10, 2009 Jan. 3, 2009 Dec. 27, 2008 2007

4,607,000 4,510,000 4,612,000 2,682,000

Nov. 8, 2008 Nov. 1, 2008 Oct. 25, 2008 2007

4,012,000 3,903,000 3,832,000 2,580,000

source: http://www.dol.gov/opa/media/press/eta/ui/current.htm

http://ows.doleta.gov/press/2008/112008.asp

10. Why is it important to know when recession ends? Because of the discounting mechanism of the stock market which precedes the economic trend by 6 to 9 months. At the end of the 1982 recession, the continuing claims reached to nearly 11 millions in November 1982.

11. This secular bear market was the worst since 1932 bear market in depression:

Start of Bear Market Duration, days Total Decline, %

3/8/1932 122 -54

10/11/2007 412 -53

3/10/1937 386 -49

1/19/1906 665 -49

9/3/1929 71 -48

11/3/1919 660 -47

4/17/1930 243 -46

6/17/1901 875 -46

1/11/1973 694 -45

7/3/1931 94 -44

9/30/1912 815 -44

12. What’s in store for 2009?

1. V-Shape recovery in economy and stock market.

a. Government spending

b. Huge cash position on the side line

c. Low interest rate

2. Deflation takes hold and economy continues to languish

a. Stimulus plan not working

b. Global recession worse then anticipated

c. Consumer debt and corp. debt at huge level

d. Credit crisis continuing spiral down

3. Slow recovery in economy and market

a. Stimulus spending stabilizing the labor market

b. Low interest rate helps the housing market

c. Corp earning improving slowly

d. Confidence comes back in the financial markets

4. Gold should be included in portfolio

a. US Dollar decline – huge federal and trade deficits

b. Relatively cheap compared to other markets – adjusted for inflation, gold is below the level seen in 1984

Potential problems around the World

- Oil price required to balance federal budgets:

c. Venezuela $97

d. Nigeria $71

e. Iran $58

f. Saudi Arabia $62

g. Russia $70

- Oil demand will surprise oil supply. Oil Reserves by Region is a big concern:

h. North America 200 billion barrels

i. Central and South America 100 billion

j. Former USSR/Eastern Europe 80 billion

k. Middle East 790 billion

l. Africa 100 billion

m. Asia/Pacific 45 billion

Dinner at Ithaka Restaurant, New York City; 12-29-2008 January 8, 2009

Posted by hslu in Restaurants, Travel.Tags: Ithaka, New York

1 comment so far

Dinner at Ithaka Restaurant, New York City; 12-29-2008

Ithaka is a little Greek restaurant about a mile away from my daughter and her husband’s apartment near York and 70th on the upper east side of Manhattan. We arrived at NY a little before 8:00 PM on Monday, 12-29-2008 after a one-night stay at Tropicana in Atlantic City. We picked up my daughter at her apartment and drove to Ithaka for a late dinner. Unfortunately her husband had to work and wasn’t able to join us. My son came home for the holidays from SF and went to Atlantic City with us. We were quite conscious with how much we could lose. We left Tropicana with about $300 loss, mostly on penny slots.

The night sky was cloudy and wind had started since late afternoon. I dropped them off at the front door and drove around to look for street parking. After a short drive, I found a good spot just a half block away. I put all my quarters in the meter but it only gave me 45 minutes. I didn’t want to park in a garage because it easily could cost me $36 for 2 hours: ~$24 for parking, $8.50 surcharge for my SUV plus $6 tax. It was that expensive in NY especially during the day when street parking was almost impossible to find. I had to feed the meter during my dinner and it was pain in the neck to come out in the cold.

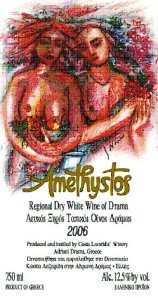

The restaurant was small: about 20′ wide and 50′ deep divided into two sections with fewer than 20 tables. It was almost empty when I came in: there were 2 other tables in addition to ours. Our table was in the back section and as soon as I sat down our waiter greeted me and asked me if he could give me some thing to drink. I opened the wine menu and wanted to order something light and fruity for our dinner. However, most wines in the menu were from Greece which I have no knowledge at all. I asked our waiter to help and he suggested a white table wine from the Drama region in Northern Greece. The Amethystos wine was produced by Domain Costa Lazaridi with beautiful art work on the bottle. I later found out that the word “Amethystos” literally means “not intoxicated” because the ancient Greeks thought that if you hold an amethyst gem in your hand while drinking wines, you would not get drunk. The dry wine was quite pleasant on the palate with bouquet of fruits I wasn’t able to identify. The low alcohol content (12.5%) made it very easy to drink even for Maria and my daughter. The $36 price tag was definitely better than I expected for a restaurant in upper east Manhattan.

We order one cold and one hot appetizer to share and three entrees:

Tzatziki: Yogurt, cucumber, dill and garlic; my daughter’s favor dish. ($7)

Kalamarkia Pan-fried baby squid. ($10.50)

Thalasino Youvetsi Shrimp, scallop, calamari and mussels with orzo pasta in fresh tomato sauce and feta cheese ($28).

Swordfish Souvlaki Boiled swordfish, onion and pepper skew ($28).

Psari Plaki Fresh snapper baked with feta cheese, tomato sauce, herbs, onions and garlic. ($23)

I didn’t order any soup because it was $7 which was more than what I could get from a French restaurant.

Tzatziki was such a simple dish to make that it was surprisingly good to the last bite. We couldn’t get enough pita bread to soak up every bit of yogurt. Pan-fried calamari was a disappointment. It came out with some kind of white creamy dressing on top. The calamari was lightly breaded than stir-fired with spices. I thought it needed more seasoning. The dressing was bland and none of us liked it. Calamari was chewy unlike the deep-fired version which we like because of its crispiness. Before our entrees came out, I went to the front of the restaurant and asked for some change to feed the meter. The hostess had warned me that New York parking patrol is notoriously bad. I guessed I had no choice but to feed the meter with two more dollars. Well, it beat spending $35 to park in a garage for 2 hours.

The swordfish Souvlaki was okay. The fish was fresh but the meat was a bit tough for my taste. It was probably over cooked. Psari Plaki was tender with good taste. The best entrée was mine: Thalasino Youvetsi. When I ordered the dish, our waiter told us that it would take 25 minutes to make. I thought that if it took that long to make it must be good. It came out in a ceramic pot about 10″ in diameter and 4″ deep. It had a generous portion of seafood: a couple of jumbo shrimps, big scallops, some calamari and a few mussels. The best part was the orzo pasta. It was cooked al dente and was soaked in the thick burgundy-colored sauce. We like it a lot and finished them all easily.

By the time we finished our dinner, the restaurant was about to close for the night. The waiters had already done their side jobs and the hostess was getting ready to go home. Our waiter said that we could stay as long as we like but it was getting late. I decided not to order any dessert but tried some Greece coffee ($3.50) instead. The coffee came out quickly in espresso size cup. It was dark and strong with good aroma but the bottom 1/5 was filled with coffee grounds. Although the waiter had warned me before I placed the order, I still swallowed some coffee grounds with my coffee. Even without the coffee ground, I don’t think I will order their coffee next time. It wasn’t as good as the espresso I had in other Mediterranean restaurants.

We left the restaurant at 10:30 PM and the total bill came to $181.18 including $30 tips.

Dinner at Jean-Georges Nougatine – Dec 24, 2008 January 6, 2009

Posted by hslu in Restaurants.Tags: Jean-Georges Nougatine

1 comment so far

Over the Christmas and New Year holiday, we had a chance to try Jean-Georges Nougatine Restaurant in New York. I have heard of Jean-George Vongerichten for some time now through magazines such as Wine Spectator and Food and Wine. I have also read articles about his restaurants in New York Times and was happy that my daughter made the reservation for the evening of December 30, 2008. My son came back from SF for the holiday and we drove to NY to visit my daughter and her husband who has to work on the Christmas Eve and New Years Eve.

The restaurant is located near Columbia Circle adjacent to the Central Park. We got there on time for the 6:30 PM reservation. I first dropped them off near the restaurant and then looked for street parking near by. When I walked into the restaurant, the hostesses greeted me warmly, took my coat and escorted me to the table. The restaurant was very crowded and was divided into two dinning areas: a noisier casual dinning area and a quieter room with formal settings. Many people sat at the bar eating and chatting when I came in. We sat in the back of the casual dinning room not far from the brightly lit open kitchen. The rectangular kitchen had seven or eight chefs working there but seemed a little small for such a busy restaurant. There were probably 20 waiters and waitresses, three hostesses plus several runners who cleaned the table and bought food to customers’ tables.

Our waiter was young, polite, tentative and warm. I ordered a bottle of Merry Edwards Sauvignon Blanc from Russian River Valley because I liked wines from this appellation. The bottle cost $92 on the menu which meant it probably retails at around $30; a little expensive for Sauvignon Blanc. I tasted the wine and liked it a lot. It was fruity with the right amount of acidity. It also has lots of citrus flavor which I enjoy very much. There were many wines much more expensive than this but I thought it was appropriate for this occasion and the setting.

We ordered two appetizers:

1. Crispy Goat Cheese Fondue with frisée, and crystallized pecans and red pear vinaigrette ($15), and

2. Bluefin Tuna Tartare with avocado, spicy radish and ginger marinade ($16).

Both were very tasty and nicely presented. The goat cheese was stuffed in a pastry shell, deep-fried and served with frisée and pecans. The vinaigrette was flavorful but I could use a little more pecans. The Bluefin Tuna Tartare was a little on the sweet side but the spicy radish paired well with fresh tuna.

For entrée, we ordered the following:

1. Steamed Skate with roasted pumpkin seeds, spaghetti squash and soy-yuzu broth ($22)

2. Pork Chop with smoked chili glaze, celeriac and sweet onions ($34)

3. Sautéed Red Snapper with caramelized cauliflower, and poppy-seed buttermilk vinaigrette ($28,) and

4. Hamburger (18.)

We all shared a small bite with the others so that we could taste different dishes. The best dish was the pork chop: tender, juicy and grilled just right. The smoked glaze added another level of flavor which was kind of special. My red snapper was also very good. The fish wasn’t over-cooked but the caramelized cauliflower was over-rated. Steamed skate (Stingray) was just okay and the spaghetti squash was a bit chewy. This was the first time I tried spaghetti squash but I didn’t particularly like its texture. I also didn’t know what soy-yuzu broth was. It turned out that yuzu is 柚子, or pomelo, a type of citrus fruit that I used to have a lot in Taiwan and soy-yuzu broth is made with soy and yuzu sauces. If I were to serve skate, I would use heavy seasoning to enhance its flavor. I may even deep-fried the skate to make it crispy and crunchy.

We also ordered two desserts:

1. Crispy warm apple cake with honey-ginger ice cream and date puree ($9,) and

2. Pear tart ($9.)

I particularly liked the combination of apple cake and honey-ginger flavored ice cream. The pear tart was okay though.

The total bill came to $287 including 8.5% tax for 5 of us. Not too bad for a Jean-Georges restaurant. Maybe we’ll try something different next time.

Christmas Dinner Party for China King Employees January 6, 2009

Posted by hslu in My Restaurant.Tags: My Restaurant

add a comment

Christmas Dinner Party for China King Employees

8 PM, Wednesday, December 24, 2008

On Christmas Eve, I closed the restaurant an hour and half earlier so that my employees can enjoy a nice party at my house. I also invited two friends over who have come to my house many times before. Maria’s brother would also come who has helped me managing the restaurant since the start of the restaurant in 2000.

I put together a menu about a week ago with many seafood dishes and bought the ingredients the day before. I started to prepare some dishes on the evening of Tuesday because I still had to work on Wednesday, the day of Christmas Eve.

I knew that one of my friends will be here early. I made eight small dishes for us so that we could some wine before my employees came over. The other friend couldn’t come early because she and her husband had to host a party for her brother’s family.

Here is the menu for our party:

Squid in Black Bean Sauce

Stewed Meat Balls, Quail Eggs and Chinese cabbage

Seared Tofu and Clam Hot Pot

Stewed Pork in Clay Pot

BBQ Beef Sirloin and Jumbo Shrimps

Bean Sprout/Korean Seaweed Salad/Crispy Peppers in hot sauce

Stir-fried Rice Noodles

Puff Pastries and Cheese cake

Seafood Soup

Beer, Plum wine and Frangelico (hazelnut liqueur)

Multi-grain Rice

Fresh Fruits

All my three chefs came. My head chef bought his wife along and the other bought his son. Almost all of my front counter staff came as well. We started eating and drinking around 8:45 PM followed by desserts. We also had karaoke for entertainment and my son also performed several Chinese songs with his unique low pitch voice. Too bad that Maria had to work the next day so that she went to bed a little after 1:30 in the morning. She would have only 4.5 hours of sleep before she had to get up to work.

My guests didn’t leave until well after 2:30 AM. Before they left, I gave them each a small Christmas gift and some chocolate and cookies which I have done so since my restaurant opened nine years ago. Maria and I spent our own money and shopped together all these years. We wanted to give them something that lasts a long time and something that’s practical and useful. The $15 to $20 gift was a small token of our appreciation to my employees; some of them have been working for us for many years. From the start of our restaurant, I have tried to treat my employees with kindness and respect. I believe that it is important to take care of the little ones in any organization because happy employees are the foundation of any successful business.